Just keep in mind that you could possibly will need to offer private details required to run a gentle inquiry with your credit rating stories. And there’s no guarantee your believed phrases is going to be your final ones.

Cost-free dollars move: Your personal debt-to-cash flow ratio doesn’t account for bills like gas, groceries and lease, so some lenders have a look at bank account transactions to view the amount of dollars borrowers have remaining immediately after other expenses.

Meeting a lender’s minimum amount credit rating score prerequisite doesn’t always mean you’ll qualify for your loan.

Have the publication Voting Booth Have you been mindful that there'll be 3 ballots for the final elections this yr? Remember to find a choice Oops! A little something went Improper, make sure you try out once more afterwards. Yes - and I know how Each individual ballot will work

Everyday living insurance guideLife insurance coverage ratesLife insurance procedures and coverageLife coverage quotesLife coverage reviewsBest existence insurance policies companiesLife coverage calculator

Own loans by means of Up grade have preset interest prices, so your price is locked in when you comply with the loan. This provides balance and predictability you'll be able to’t get having a variable desire price.

Get the cost-free credit rating scoreYour credit rating reportUnderstanding your credit scoreUsing your creditImproving your creditProtecting your credit score

Other merchandise and enterprise names outlined herein will be the home of their respective owners. Licenses and Disclosures.

Credit card debt consolidation was the commonest motive people today borrowed dollars, followed by household enhancement and also other huge expenses.

When you have a 450 credit history rating, lenders will choose that as a sign that you just’ve experienced problems with financial debt before. It could point out that you simply’ve skipped payments or defaulted on loans, and even that you choose to’ve declared personal bankruptcy or been via a foreclosure.

The lender may be able to allow you to solve it before the late payment is extra to your experiences. But when it's been properly reported, a late payment may be challenging to eliminate from the credit stories.

House loan curiosity prices as well as other costs vary radically from lender to lender. You may compare present desire premiums swiftly by making use of a System like Credible. The website delivers rates from here thirteen distinctive property loan organizations in order to look for the ideal property finance loan charges.

FICO® Scores inside the Quite Weak vary often reflect a background of credit rating missteps or problems, for instance various missed or late payments, defaulted or foreclosed loans, and in some cases individual bankruptcy.

As talked about, lenders consider the residence’s LTV ratio when environment property loan fees. The greater you place toward your deposit, the lower your LTV, which subsequently lowers your curiosity charge. Aiming for twenty% could also preserve you funds on the price of non-public property finance loan insurance.

Luke Perry Then & Now!

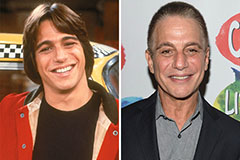

Luke Perry Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!